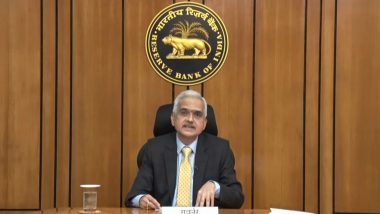

Mumbai, February 10: In the last monetary policy review of the current financial year, the Reserve Bank of India (RBI) on Thursday decided to keep repo and reverse repo rates unchanged. The six-member Monetary Policy Committee headed by Reserve Bank of India Governor Shaktikanta Das decided to maintain the status quo on key policy rates for the 10 consecutive time.

"Monetary Policy Committee (MPC) has unanimously decided to keep the repo rate unchanged at 4 per cent," the RBI Governor said in his Monetary Policy Statement. The repo rate is the interest rate at which the RBI lends short-term funds to banks.

The reverse repo rate, the interest rate at which the RBI borrows from banks, remains unchanged at 3.35 per cent. This is the 10 consecutive policy review when the RBI has decided to maintain a status quo on key policy rates. The central bank has not changed repo and reverse repo rates since May 2020. RBI Monetary Policy 2022: Reserve Bank of India Keeps Repo Rate Unchanged at 4%.

Das said the Monetary Policy Committee has also decided to maintain an accommodative policy stance. The RBI Governor made a monetary policy statement after three days of deliberations by the Monetary Policy Committee that met 8-10 February.

(The above story is verified and authored by ANI staff, ANI is South Asia's leading multimedia news agency with over 100 bureaus in India, South Asia and across the globe. ANI brings the latest news on Politics and Current Affairs in India & around the World, Sports, Health, Fitness, Entertainment, & News. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly