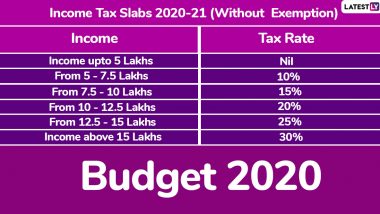

New Delhi, February 1: Union Finance Minister Nirmala Sitharaman on Saturday unveiled a new "optional" income tax regime in the Union Budget for the financial year 2020-2021. Under the new income tax rates and slabs, individual taxpayers will have to pay 10 percent tax on income between Rs 5 lakh and Rs 7.5 lakh, 15 percent on income between Rs 7.5 lakh and Rs 10 lakh, 20 percent on income between Rs 10 lakh and Rs 12.5, and 25 percent on income between Rs 12.5 lakh and Rs 15 lakh. One can download the image of new income tax rates and slabs here. Budget 2020-21 Live Streaming: Watch Online Telecast of Nirmala Sitharaman Delivering Budgetary Speech And Unveiling 'Bahi Khata'.

"In this new personal income tax regime, income tax rates will be significantly reduced for the individuals who forgo certain exemptions and deductions," Nirmala Sitharaman announced. At present, individual taxpayers pay 5 percent tax on income between Rs 2.5 and 5 lakh, 20 percent on income between Rs 5 lakh and Rs 10 lakh and 30 percent on earnings of over Rs 10 lakh. "A person earning between Rs 5-7.5 lakhs will be required to pay tax at 10 percent against current 20 percent," Sitharaman said.

"Those with income between Rs 7.5-10 lakhs to pay tax at 15 percent against the current 20 percent. Those with income between Rs 10-12.5 lakhs to pay tax at 20 percent against 30 percent," the Union Finance Minister announced. "A person earning Rs 15 lakh per annum and not availing any deductions will now pay Rs 1.95 lakh tax in place of Rs 2.73 lakh," she said. The income tax exemption limit of Rs 2.5 lakh has been kept unchanged. Sitharaman also announced to abolish Dividend Distribution Tax for companies. "Dividend will be taxed only at the hands of recipients at applicable rates," she said.

New Income Tax Rates And Slabs For 2020-21:

| Income Per Annum | Existing Tax Rate | New Tax Rate |

| Rs 0-2.5 Lakhs | 0% | 0% |

| Rs 2.5-5 Lakhs | 5% | 5% |

| Rs 5-7.5 Lakhs | 20% | 10% |

| Rs 7.5-10 Lakhs | 20% | 15% |

| Rs 10-12.5 Lakhs | 30% | 20% |

| Rs 12.5-15 Lakhs | 30% | 25% |

| Above Rs 15 Lakh | 30% | 30% |

Here's the Current Income Tax Rates And Slabs:

| Income Slabs (Individual below 60 years of age) | Tax Rates | Income Slabs (resident & above 60 years but below 80 years) | Tax Rates | Income Slabs (resident & above 80 years) | Tax Rates |

| Total income up to Rs. 2.5 Lac | NIL | Total income up to Rs. 3.00 Lac | NIL | NA | NA |

| Total income exceeds Rs. 2.5 Lac but less than Rs.5 Lac | 5% on amount exceeding Rs. 2.5 Lac | Total income exceeds Rs. 3 Lac but less than Rs.5 Lac | 10% on amount exceeding Rs. 3.00 Lac | Total income up to Rs. 5 Lac | NIL |

| Total income exceeds Rs. 5 Lac but less than Rs.10 Lac | 20% on Income exceeding Rs. 5 Lac + Rs. 25,000 | Total income exceeds Rs. 5 Lac but less than Rs.10 Lac | 20% on Income exceeding Rs. 5 Lac + Rs. 20,000 | Total income exceeds Rs. 5 Lac but less than Rs.10 Lac | 20% on Income exceeding Rs. 5 Lac |

| Total income more than Rs. 10 Lac | 30% on Income exceeding Rs. 10 Lac + Rs. 1,25,000 | Total income more than Rs. 10 Lac | 30% on Income exceeding Rs. 10 Lac + Rs. 1,20,000 | Total income more than Rs. 10 Lac | 30% on Income exceeding Rs. 10 Lac + Rs. 1 Lac |

In 2014, then Union Finance Minister Arun Jaitley, presenting his first Budget, increased the tax exemption limit from Rs 2 lakh to Rs 2.5 lakh for people below 60 years of age and for senior citizens, the limit was increased to Rs 3. Jaitley also raised the maximum deduction limit under Section 80C from Rs 1 lakh to Rs 1.5 lakh. The 10 percent, 20 percent and 30 percent tax slabs for income between Rs 2.5-Rs 5 lakh, Rs 5 lakh-Rs 10 lakh and above Rs 10 lakh were kept unchanged respectively.

In 2015, Jaitley increased the maximum limit u/s 80D from Rs 15,000 to Rs 25,000 for people under 60 years of age and from Rs 20,000 to Rs 30,000 for senior citizens. Other tax slabs and income tax exemption limit were not touched. However, the rate of surcharge on income exceeding Rs 1 crore was increased from 10 per cent to 12 per cent, but the wealth tax was abolished.

In 2016, Jaitley raised the maximum tax rebate from Rs 2,000 to Rs 5,000 for people having taxable income of up to Rs 5 lakh. The rate of surcharge on income exceeding Rs 1 crore was increased from 12 percent to 15 percent.

In 2017, Jaitley reduced the minimum income tax rate from 10 per cent to 5 percent for income upto Rs 2.5 lakh. He also introduced 10 percent surcharge on income between Rs 50 lakh and Rs 1 crore, while the rate of surcharge on income exceeding Rs 1 crore was kept unchanged at 15 percent.

In 2018, tax slabs, rates and income tax exemption limit were not changed. In 2019, then interim Finance Minister Piyush Goyal increased the tax rebate from Rs 2,500 to Rs 12,500 for taxpayers having taxable income up to Rs 5 lakh, which effectively ensured that they don't have to pay any tax.

In July 2019, present Finance Minister Nirmala Sitharaman introduced new surcharge rates of 25 per cent for income above Rs 2 crore and up to Rs 5 crore and 37 per cent surcharge on income above Rs 5 crore. She did not touch the tax slabs, rates and income tax exemption limit for individual taxpayers earning below Rs 2 crore annually.

(The above story first appeared on LatestLY on Feb 01, 2020 03:25 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly