By Nikhil Dedha

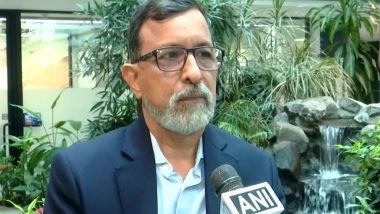

Mumbai (Maharashtra) [India], February 6 (ANI): The Reserve Bank of India's (RBI) latest Monetary Policy Committee (MPC) decision reflects confidence in the country's growth-inflation dynamics, with stable economic momentum and a gradual normalisation of inflation supporting the continuation of a neutral policy stance, according to Dharmakirti Joshi, Chief Economist at CRISIL.

Also Read | Matt Batista Epstein Island Video: What Really Happened?.

In an exclusive conversation with ANI, commenting on the MPC outcome, Joshi said the decision to keep policy rates unchanged indicates that the committee is largely satisfied with the prevailing growth and inflation outcomes.

He said, "I expect the stance to remain neutral. So what this policy move of not changing rates means is that the committee is quite satisfied with the growth and inflation outcomes. If you look at the mindset of what they have said, I think they raised inflation a little bit up and also growth a little bit up. And a few days back, the economic survey had also pointed out that the potential of the economy is now close to 7 per cent. And I think RBI forecasts are also in that range. So there was space to cut rates, but there is no need to cut rates at this time".

Also Read | Where to Watch NFL Super Bowl LX Live Streaming in India?.

An important consideration behind the RBI's cautious approach, he added, is the impending release of consumer inflation and GDP data with a new base year. This rebasing exercise, he said, represents a major overhaul after a long gap and could have implications for estimates of the economy's size and growth pace.

The central bank, therefore, would prefer to factor in these changes before making firm projections for the coming financial year.

Looking ahead, Joshi said investment is likely to remain supportive, aided by measures announced in the Union Budget. He added that private consumption, particularly in rural areas, is showing improvement, supported by good rainfall, healthy reservoir levels, and favourable monsoon progress.

He said, "I think the investment support is there from the budget, so investment will continue to remain a supportive factor. And private consumption, rural is looking good because the monsoon, the rains and the reservoir levels are good, so monson is progressing well........So I think overall I would say that I think the growth inflation mix is looking good even for the coming fiscal year".

On inflation, Joshi described 2025-26 as an unusual year marked by very low inflation, largely due to a sharp decline in food prices that resulted in negative inflation for a period.

Going forward, inflation is expected to move up, with the Reserve Bank of India projecting inflation slightly above 4 per cent in the first half of the next financial year, in line with its target.

He said this normalisation of inflation would support higher nominal GDP growth, improve tax collections, and strengthen corporate balance sheets, even as price pressures remain within comfortable limits.

Commenting on recent MPC measures, including the doubling of the collateral-free loan limit for MSMEs to Rs 20 lakh and reviews of schemes such as the Kisan Credit Card Joshi said, "I think these are steps that are being regularly taken in every policy. So they incrementally, I think, support the economy, support the credit. I think if you ask me, are they going to make a very big difference? Not. But are they going to make a positive difference? Yes".

Overall, Joshi said both fiscal and monetary policy are supportive of growth without being inflationary. The MPC outcome, he added, was largely in line with expectations, with greater clarity on the growth and inflation outlook likely once rebased inflation and GDP data are released. (ANI)

(The above story is verified and authored by ANI staff, ANI is South Asia's leading multimedia news agency with over 100 bureaus in India, South Asia and across the globe. ANI brings the latest news on Politics and Current Affairs in India & around the World, Sports, Health, Fitness, Entertainment, & News. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly