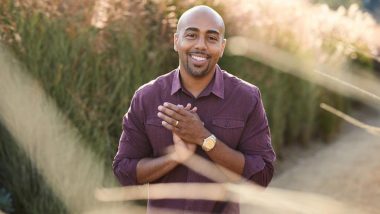

Tory Owens didn’t decide from the get-go to enter the niche field of structured settlements. It’s not the kind of thing many people are familiar with, after all. Born in Bakersfield, California, Owens attended Clark Atlanta University for school, a historically black college in Georgia, with a background in mortgage banking and real estate. After being a real estate agent for several years, Owens began working as a home loan auditor for Bank of America and shortly after as a mortgage underwriter for Wells Fargo. It was then that one of his former co-workers from Bank of America randomly called Owens to update him about his new line of work. He called Owens and explained that he was now selling annuities, and that he had Owens covered if he ever knew someone who needed an annuity. At that time, Owens showed little to no interest.

One week later, Owens was hanging out with his best friend who was also an attorney. This friend had just settled a case against the Los Angeles Unified School District involving 81 children, and suddenly he brought up the topic of buying annuities for these kids.

At this moment, a switch went off in Owens’ head and he began his attempt to set up his attorney friend with his former co-worker and his partners who sold annuities. Though his best friend was hesitant at first, Owens set up a deal between the two parties. This was his way of getting his foot in the door. As a condition, he asked for the referred parties involved to hire him after he got licensed, based on the work he did to set up that deal, and the man agreed.

However, things weren’t that simple. It is a competitive industry. After the deal was done the referred party disappeared and would not return any of Owens’ calls. Still determined, Owens got in contact with the president of the referred party’s company in an attempt to hop aboard after receiving his license, but after a phone call, he never heard back. Owens didn’t give up, however. He found another company, and rather than inquiring entirely through phone, he went to their corporate office in Orange County.

He knew that they were likely to treat him dismissively. He had only a real estate resume to his name and came with the intention of talking to someone and breaking through with his charisma and speaking skills alone. He was able to get the company’s secretary to bring the CFO to him for a meeting, and when the CFO appeared, he looked over at Owens and said, “you have five minutes. Give me your spiel.”

Five minutes turned into twenty-five minutes. Owens spoke about the attorneys he knew, and the case he helped closed. He insisted that he didn’t even have to get paid by the company; all he wanted was knowledge, to learn the tools of the trade, and gain that experience he needed. The CFO connected him with a man in Costa Mesa, CA that interviewed him, and soon after Owens was being mentored as a structured settlement consultant.

Owens quickly discovered how racially homogenous and nepotistic the industry was. As a black man, he would arrive at industry events to find he was the only person of color there. At the time, he was the only black American at his company, which was a nationwide business. He had to learn to adapt to this, to work his way into circles where everyone came from a different background. Despite these struggles and his lack of comfort, he worked hard to insert himself into these circles, to become better known in the industry. Suddenly, he had hopped from one industry to a highly-competitive, completely unrelated one, simply through ambition and charisma, despite all the challenges along the way.

Owens chalks it up to networking. He developed relationships, did good work without expectation of compensation, and used his observations of the industry around him to his advantage. Now, it has paid off. He is recognized at every event he attends and works full-time as a structured settlement consultant. Tory Owens’ story is one of perseverance and goes to show that you can break into any field with enough drive and dedication.

Quickly

Quickly