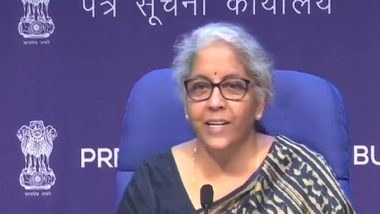

New Delhi, Aug 4: Finance Minister Nirmala Sitharaman on Tuesday told the Rajya Sabha that the average annual revenue collection, including GST and excise duty, from tobacco products, stands at about Rs 53,750 crore.

In reply to a question, the minister also said the GST rates, including compensation cess rates, on goods are fixed on the basis of the recommendations of the GST Council.

Answering supplementary questions, she said many non-governmental organisations (NGOs) and consumer education forums have suggested to increase levies on tobacco products considering the health impact. Uttar Pradesh: Licence Needed to Sell Tobacco Products.

"In the GST Council, we have formed a Group of Ministers (GoM). It has been given the terms of reference to see if on the capacity of a producing unit, where evasion is high, we can consider looking at an increase in the price.

"Such items like tobacco have also been put into that list... We will wait for the GoM to come back with its recommendations," she said.

Prasanna Acharya (Biju Janata Dal) had asked her if the central government will put the proposal in the GST Council for increasing tax on tobacco.

In the written reply, Sitharaman said the average annual revenue collection (based on the last three years) including GST, compensation cess, excise duty and national calamity and contingent duty (NCCD) from tobacco products, is about Rs 53,750 crore.

She also said excise duty and NCCD on tobacco products are levied by the central government and there is no proposal at present for imposition of any additional duty.

(The above story is verified and authored by Press Trust of India (PTI) staff. PTI, India’s premier news agency, employs more than 400 journalists and 500 stringers to cover almost every district and small town in India.. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly