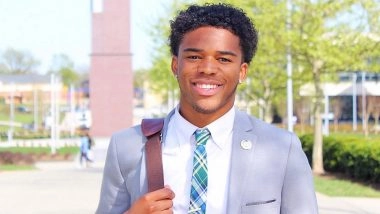

Nigel Hammett is a young entrepreneur who graduated from North Carolina A&T. Hammett seeks to mobilize the members of his community by encouraging his peers to invest and learn income-producing skills. He embodies an ambitious individual that others should observe to grasp the proper manner in which young adults can sustain a healthy financial lifestyle. Hammett currently works in Chicago as a Facebook Account Manager. By living below his means and allocating his funds in a way that allows him to still enjoy his life, Hammett successfully paid off all $48,00 First, Nigel Hammett feels obligated to stress how important it is for young people to live below their means. Hammett grew up in the Baltimore Area and he is a college graduate; therefore, he is well aware of the struggles that people face when trying to properly manage their money. Hammett explains that he wasn’t always as financially literate as he is today, and he has suffered minor spending troubles of his own. It is evident that when people don’t have access to a lot of their desires in life due to monetary absence, they tend to quickly spend the money they earn on things that depreciate. Essentially, millennials often spend money on the things they want without first catering to their financial obligations. Hammett personally ensures that his total expenses for the month never exceeds $1,500. He doesn’t have an extravagant apartment, nor does he own a car; therefore, Hammett has opted to ride the bus and take the train to get to work every day from his Southside Chicago home.

Secondly, Hammett offers some insight into his own lifestyle choices, so people recognize that it is possible to become as financially sound as he has at the age of 23. As a black man who just recently graduated from college in 2018, Hammett serves as a role model for older teenagers and college students who must soon prepare to survive off of their own means. As a Facebook employee, Hammett earns about $65,000 per year. He’s an avid investor and businessman determined to make at least $1,500 a week outside of Facebook to meet his goals. Hammett also operates e-commerce stores and his own resume 0 of his student loan debt in only 10 months.

business called “Resume Plug.” “Resume Plug” strives to combat the disparities that Minorities and Women face in the workplace. By charging clients $150 for a well-crafted resume, “Resume Plug” offers clients opportunities to secure a better job and ultimately obtain better a better future.

Finally, Hammett explains how crucial it is that young people establish a budget plan which allows them to remain responsible while still having fun. As soon as Hammett has reached his weekly savings goal of about $1,200-$1,500, he is then able to spend any remaining funds he has earned that week on whatever he pleases. With a background in Cryptocurrency and Foreign Exchange, Hammett managed to earn roughly $500-$1,000 every week solely from trading and investing. These funds truly helped him to pay off his student loan debt. Hammett graduated in December 2018, so his first student loan payment was due on June 1, 2019. Hammett soon made his final payment, thus relieving him off his $48,000 debt, on March 6, 2020. The budget plan he has devised has allowed him to pay off his debt, live comfortably, and even travel to other countries such as the United Kingdom and Canada for pleasure. Hammett achieved this monumental debt-free accomplishment by simply maintaining multiple streams of income. As an apparent young success, Hammett is an absolute inspirational source for young adults all over the world who are still figuring out their path in life.

Quickly

Quickly