New Delhi [India], November 29 (ANI): Foreign portfolio investors have infused funds worth Rs 32,344 crore in Indian stock markets so far in the month of November and became net buyers again, data from National Securities Depository showed.

In September and October, they were net sellers amid the strong US dollar index, weak rupee, and tightening of monetary policy.

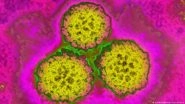

Also Read | Monkeypox Renamed As 'Mpox' To Avoid Racist Stereotypes, WHO Phases Out Former Name Amid Global Outbreak.

Notably, barring July and August and the current month when they were net buyers, foreign portfolio investors (FPIs) had been selling equities in the Indian markets for a year, which started in October 2021 for various reasons.

So far in 2022, they sold Rs 136,453 crore worth of stocks in India on a cumulative basis, NSDL data showed.

Also Read | Gemma Chan Birthday: Best Red Carpet Appearances of the ‘Eternals’ Actress.

Tightening monetary policy in advanced economies including rising demand for dollar-denominated commodities, and strength in the US dollar had triggered a consistent outflow of funds from Indian markets. Investors typically prefer stable markets in times of high market uncertainty.

The latest inflow of funds supported Indian stocks recently. Extending gains from the previous session, Indian stock indices rose this morning and hit a fresh lifetime high.

Also, a hint by the US Fed about possible slowing down on policy rates too supported the ongoing rally in the Indian stock markets. (ANI)

(The above story is verified and authored by ANI staff, ANI is South Asia's leading multimedia news agency with over 100 bureaus in India, South Asia and across the globe. ANI brings the latest news on Politics and Current Affairs in India & around the World, Sports, Health, Fitness, Entertainment, & News. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly