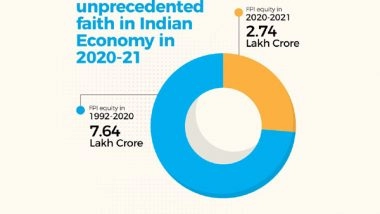

New Delhi [India], Sep 9 (ANI): India emerged as one of the most favoured destinations for global fund managers with foreign portfolio investment (FPI) inflows into equity markets totalling Rs 2.74 lakh crore in 2020-21.

The FPI equity during 1992-2020 was to the tune of Rs 7.64 lakh crore, government data shows.

Nearly 26 per cent of total FPI equity (foreign portfolio investment) inflow in India over the past 30 years came in 2020-21.

This was despite Covid-19 pandemic leading to a countrywide shutdown of business and economic activities, reflecting confidence of foreign investors in the fundamentals of Indian economy.

Also Read | Pune Woman Strangulates Live-In Partner To Death, Arrested.

The rise in foreign fund inflows have led equity benchmark indices to touch record new highs. (ANI)

(The above story is verified and authored by ANI staff, ANI is South Asia's leading multimedia news agency with over 100 bureaus in India, South Asia and across the globe. ANI brings the latest news on Politics and Current Affairs in India & around the World, Sports, Health, Fitness, Entertainment, & News. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly