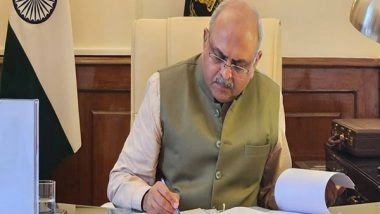

New Delhi [India], June 28 (ANI): The Appointments Committee of the Cabinet has approved the re-appointment of Ravi Agrawal, as Chairman of the Central Board of Direct Taxes (CBDT) on a contract basis for one year, effective from July 1, 2025, to June 30, 2026, or until further orders, according to an official order.

Last year, Agrawal, a 1988-batch IRS officer, was appointed as the new chairman of the Central Board of Direct Taxes, the administrative body for the Income Tax Department.

With the reappointment, the CBDT is expected to move forward with various pending initiatives aimed at streamlining tax administration and enhancing taxpayer services nationwide.

The Appointments Committee of the Cabinet in April approved the appointment of four senior Indian Revenue Service (IRS) officers as Members of the Central Board of Direct Taxes (CBDT).

The CBDT is the apex policy making body for the Income-tax department. The CBDT is headed by a chairman and can have six members who are in the rank of special secretary.

The Board plays a crucial role in formulating policies for tax collection, combating tax evasion, and implementing various direct tax reforms.

The Central Board of Direct Taxes is a statutory authority constituted under the Central Board of Revenue Act, 1963. The officers of the Board in their ex-officio capacity also function as a Division of the Ministry dealing with matters relating to levy and collection of direct taxes.

The Central Board of Revenue as the apex body of the Department, was entrusted with the task of administration of taxes. It came into existence as a result of the Central Board of Revenue Act, 1924.

Initially, the Board was in charge of both direct and indirect taxes. Subsequently, the Board was split up into two, namely the Central Board of Direct Taxes and Central Board of Excise and Customs with effect from January 1, 1964. This bifurcation was brought about by constitution of two Boards u/s 3 of the Central Board of Revenue Act, 1963. (ANI)

(The above story is verified and authored by ANI staff, ANI is South Asia's leading multimedia news agency with over 100 bureaus in India, South Asia and across the globe. ANI brings the latest news on Politics and Current Affairs in India & around the World, Sports, Health, Fitness, Entertainment, & News. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly