This year's World Economic Forum at Davos had world and business leaders take a different tone towards the crypto world. Gone are the days of suspicion and derision. Instead, this year's conference felt like it belonged to powerful and influential crypto optimists.

Leading the charge was US policymakers with promises of coming legislative clarity and frameworks. Tokenization of other asset classes was a hot topic, with metals and real estate taking some of the spotlight for future tokenization possibilities. Finally, AI and how it could interact with cryptocurrencies in the future also had its time in the spotlight during the conference.

US Makes Moves Towards Crypto Leadership

During his 90-minute speech, US President Trump touched on cryptocurrency briefly, but impactfully. Amongst his comments were personal guarantees relating to the ongoing battle for the Clarity Act, stating that Congress is “working very hard on crypto market structure”, thus “unlocking new pathways for Americans to reach financial freedom”. Speaking on the act's failure to pass so far, White House Crypto Czar David Sacks said “we’ve seen this movie before”, and the administration fully expects it will take a few tries to get it through.

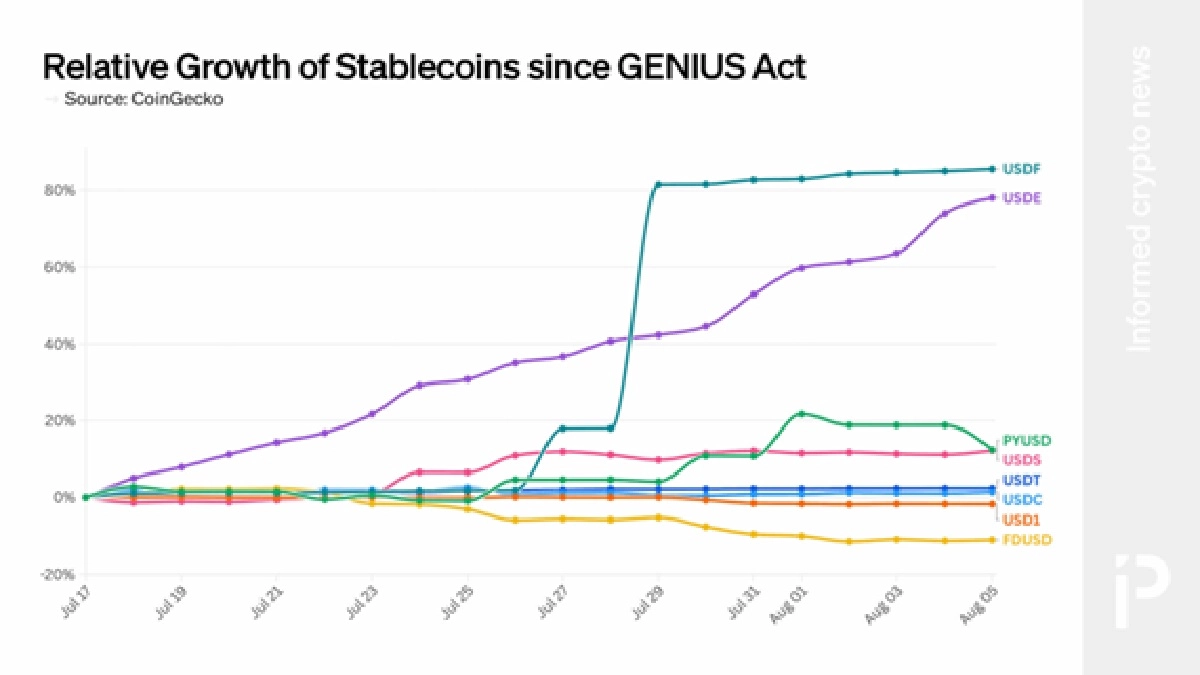

The Clarity Act represents the next phase of U.S. crypto market structure regulation, building directly on the groundwork established by the GENIUS Act. Passed in 2025, the GENIUS Act resolved the stablecoin question by creating a clear regulatory framework for dollar-backed digital assets, and unlocking institutional participation giving the U.S. an early advantage. The Clarity Act now seeks to extend that certainty across the broader digital asset market, moving beyond stablecoins to define how crypto markets operate at scale.

As outlined in remarks at Davos, the stated objective of U.S. crypto policy is to “ensure America remains the crypto capital of the world.” That language echoes an executive order issued last year highlighting the gap between policy intent and fully realized regulation.

For other countries looking to secure their own position in a crypto-driven future, Binance Co-CEO Richard Teng offered some advice for leaders that he suspects may be going in the wrong direction.

Speaking to CNBC-TV18 at Davos, Teng stated that following current legal trajectories, the US will be "on the leading edge" of blockchain business growth. Other countries, he added, will need to "rethink their approach towards AI and blockchain" so that they don't risk losing their competitive advantages. His warning carries particular weight given that the US has already cleared the stablecoin hurdle with the GENIUS Act while other nations remain mired in debate over basic regulatory frameworks.

Teng specifically pointed to India as a cautionary tale. The country is hemorrhaging technical talent to more welcoming jurisdictions despite ranking number one globally in crypto adoption. This dynamic underscores Binance's positioning not merely as an exchange seeking licenses but as a pro-innovation advocate championing regulatory clarity that serves global users and preserves national competitiveness.

More Assets Moving On-Chain

Law-focused developments aside, one goal blockchain proponents have been imagining for years is a future where most ownership contracts (think real estate deeds, claims on gold and silver stockpiles, etc.) are tokenized and traded on-chain. While this has been a popular enthusiast talking point for years now, not much has materialized until very recently.

In his interview with CNBC-18, Richard Teng commented that “all asset classes are moving on-chain now”, but overall the process is just beginning to take shape.

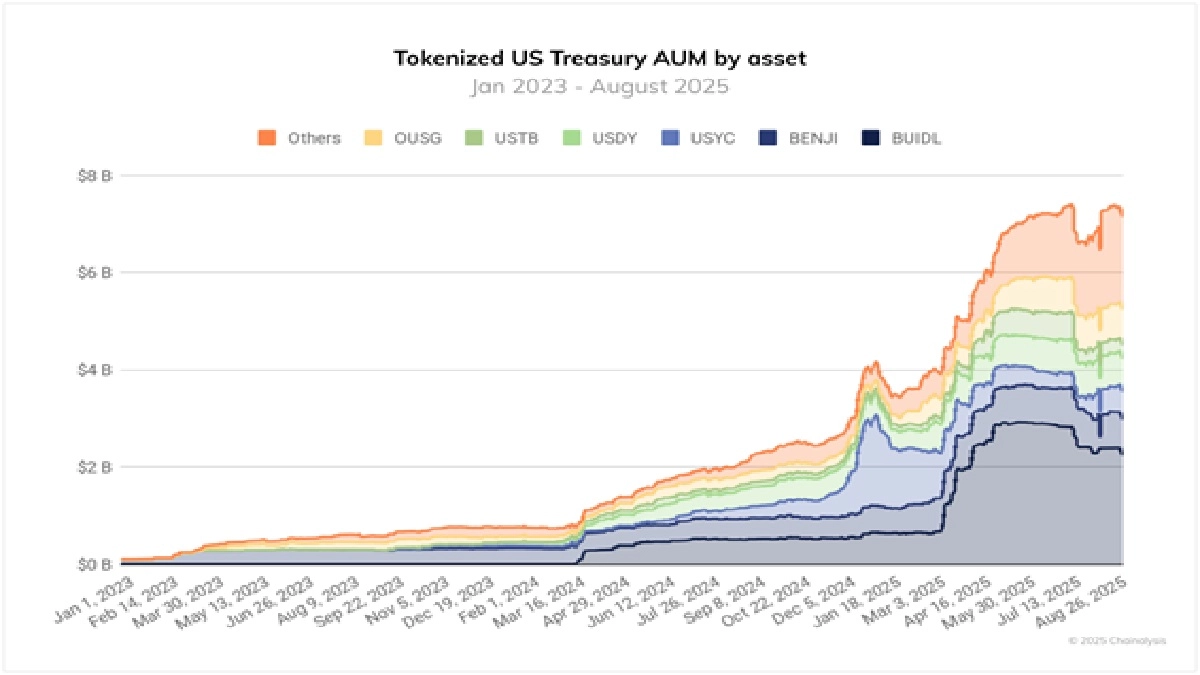

Specifically, Teng pointed out the company's recent addition of gold and silver perpetual contracts, something that their user base has had a "very robust response" to. The move signals Binance's evolution into a multi-asset platform where users can hedge against crypto volatility using commodities, all within the same ecosystem. In 2025, gold rose 67% and silver surged 152%, while BTC remained relatively flat, demonstrating the value of diversification for crypto-native investors. US Treasury assets are also quickly being tokenized through a number of entities.

While physical commodities and assets cannot be traded entirely online, it would seem that proponents of blockchain technology are making big strides towards having the contractual side of asset and commodity ownership be tokenized. The dream being that eventually, something like home ownership would be simplified into just holding a token representing ownership. Selling your house would similarly boil down to just sending someone else that ownership token in exchange for payment. That specific dream appears to still be a long way off, however.

AI To Make More Crypto Transactions Than Humans?

AI was also the subject of much speculation, especially with how it could intertwine with cryptocurrencies in the coming years. During the WEF in Davos, Binance General Counsel Eleanor Hughes commented, “Technological innovation, especially the fusion of AI and blockchain, will enhance security, efficiency, and user experience.”

Her reasoning is fairly straightforward. “Firms are prioritizing internal, lower-risk uses for Generative AI to enhance productivity, generate insights, and improve risk management, rather than deploying it in customer-facing applications,” said Hughes.

The legacy financial system relies on bank accounts and credit cards, instruments and tools that require a human to be responsible for them or to set them up. In a future with near infinite scaling and exponential expansion of what automated agents can do, AIs will need a digitally native way to exchange value. That, Hughes implies, is where crypto and AI will feed off of each other.

Now that the GENIUS Act has laid the groundwork for stablecoins to potentially see wider use and acceptance by legacy financial institutions, it's not much of a stretch to imagine automated AI agents using them when you ask for help making your next lunch delivery order.

This represents the ultimate proof of frictionless finance. If an AI can hold a stablecoin regulated under the GENIUS Act and pay for a service without a human-signed credit card, the digital asset future has officially arrived. What was once theoretical has become practical.

Wrap Up

Davos 2026 marked a clear inflection point in how digital assets are discussed at the highest levels of global finance. Crypto was no longer treated as a peripheral experiment or a risk to be contained, but as a maturing set of technologies increasingly intertwined with policy, capital markets, and emerging infrastructure. The presence of policymakers, institutional leaders, and technologists speaking in pragmatic terms signaled that the conversation has moved decisively from “if” to “how.”

What stood out most was not a single breakthrough announcement, but the convergence of narratives. Legislative clarity, tokenized real-world assets, and AI-driven financial systems were no longer siloed ideas. Together, they painted a picture of a financial system in transition where digital assets are becoming foundational rather than optional.

Crypto’s journey from the sidelines to the spotlight did not happen overnight, and skepticism has not disappeared entirely. But Davos made it clear that digital assets are now part of the strategic playbook for governments and institutions alike. The next chapter will be defined less by debate and more by execution, as global finance begins to operationalize the ideas that, just a few years ago, were still viewed as fringe.

(All articles published here are Syndicated/Partnered/Sponsored feed, LatestLY Staff may not have modified or edited the content body. The views and facts appearing in the articles do not reflect the opinions of LatestLY, also LatestLY does not assume any responsibility or liability for the same.)

(The above story first appeared on LatestLY on Feb 12, 2026 01:09 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly