By OffshoreCorpTalk Research Team

Global e-commerce has opened unprecedented opportunities for exporters, software developers, and service providers. Yet behind the growth headlines lies a quieter struggle: merchants may win initial approval to process payments, only to discover that the real difficulties begin afterwards.

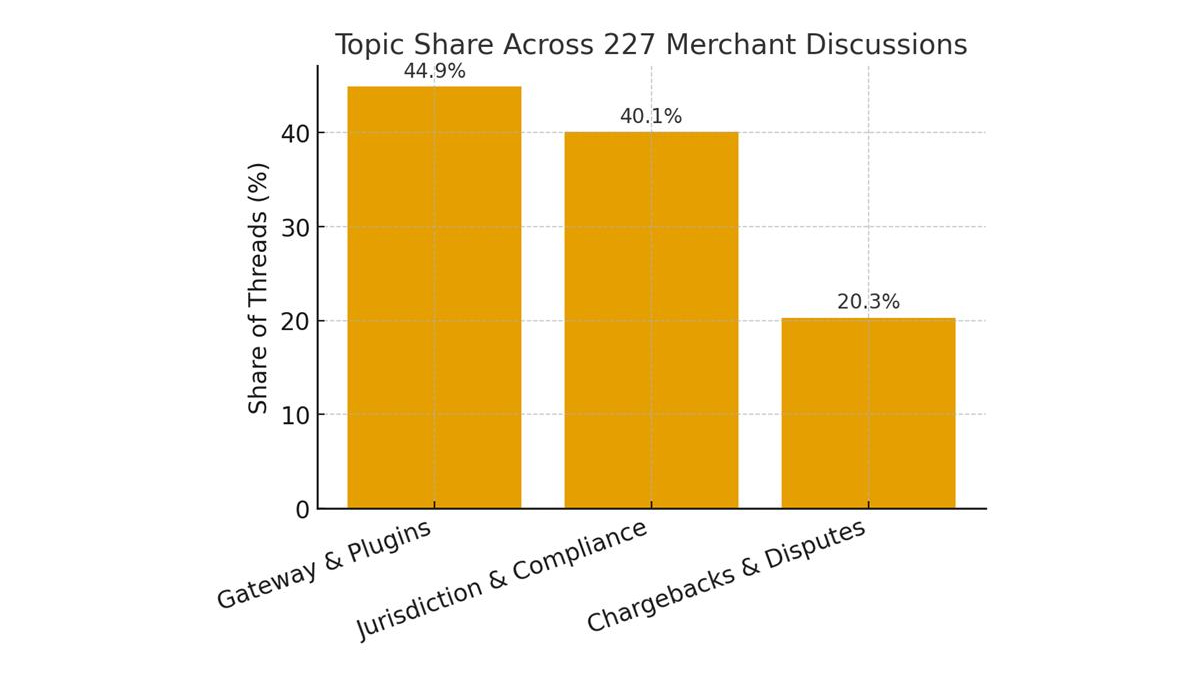

A new review of 227 merchant cases, drawn from open community discussions, shows a clear pattern. Exporters worldwide face recurring frictions with gateway technology, compliance rules, reserves, and payout timing. These operational details can make the difference between scaling a business and running into unexpected roadblocks.

The problem is Global

When merchants sign up with an acquirer or payment provider, the expectation is straightforward: once approved, funds will flow smoothly. But the dataset tells another story.

- Gateway and plugin maturity dominates discussions. Nearly half of all first posts (44.9 percent) involve questions on setup, tokenization, subscription renewals, or refunds.

- Jurisdiction and compliance hurdles appear almost as often (40.1 percent).

- Chargebacks and disputes remain a universal challenge, raised in 20.3 percent of cases.

The most stressful episodes are not about getting an account approved. They are about sudden reserve hikes, a shift from daily to weekly funding, or a cap on transaction volume that appears without warning.

Figure 1. Topic share across 227 merchant discussions.

Data-Backed Insights

The review tracked operational signals across the 227 discussions. In 48 cases, merchants named specific acquirers or gateways. In 32 cases, payout calendars were described in detail. In 19 cases, reserve formulas and release cadences were documented.

Mentions of providers clustered around Stripe, PayPal, and Payoneer. Jurisdictions most frequently cited were the UK, US, and EU. Volumes peaked in late 2024, coinciding with policy changes and tighter gateway controls.

Why It Matters for India and Beyond

India is one of the fastest-growing e-commerce markets in the world. Exporters from Bangalore to Mumbai are looking abroad for customers, while global platforms are expanding into India. But these payment frictions are not limited to any one country.

Merchants in India, Nigeria, the UK, and the US describe the same patterns. Plugin maturity, reserve opacity, and unpredictable funding cycles cut across regions. That is why this dataset, though drawn from international discussions, resonates deeply with Indian entrepreneurs.

Practical Checklist for Merchants

The dataset suggests exporters can reduce surprises by securing key facts in writing before traffic goes live. A buyer’s checklist includes:

- Acquirer name and settlement country

- Merchant Category Code (MCC) and applicable rules

- Unique MID confirmation – and controls if the MID is shared

- Pricing breakdown: discount, cross-border, tokenization, batch, minimums

- Reserve formula, release cadence, and a hard cap

- Funding calendar with clear daily cut-offs and triggers for weekly funding

- Dispute and alert workflows, reason-code templates, and deadlines

- Official gateway plugins, supported versions, SLA, and sandbox access

The Broader Significance

While the sample represents community-sourced cases, not industry-wide statistics, the consistency is striking. Exporters across continents report the same themes:

- Approval is quick, but funding is fragile.

- Authentication shifts fraud liability, but does not end disputes.

- Reserves are acceptable when formulas are written and capped, but damaging when imposed without notice.

For fintech providers, this offers an opportunity. Transparency on underwriting, reserves, and payout schedules can differentiate a provider in an increasingly competitive market. For merchants, the lesson is pragmatic: plan for disputes, negotiate clarity, and run capped pilots before scaling.

Conclusion

Global e-commerce is not slowing down. But exporters must recognize that the hardest work begins after approval. Gateway maturity, compliance hurdles, reserves, and payout timing can quietly erode business momentum if left unmanaged.

Predictable cross-border processing depends on three things: underwriting clarity, authentication that fits risk, and clear dispute workflows. Exporters who demand these facts up front, and fintech providers who supply them, will be the ones best placed to scale across borders.

This article is based on a review of 227 merchant discussions from OffshoreCorpTalk’s public forums. A full global report is available upon request.

Quickly

Quickly