We are no longer in an experimental market. The digital asset space has entered a cycle defined by hard governance and professional access. This evolution set the tone for Binance Blockchain Week 2025, where the dialogue centered on regulation as a driver of maturity.

Richard Teng, Co-CEO of Binance, used growth metrics to illustrate the point, noting, "We've doubled institutional onboarding year-on-year—the long-term trend is crystal clear." The industry has moved beyond the "wait and see" approach, with institutions now actively participating in a market defined by clear rules rather than ambiguity.

From Speculation to Strategic Allocation

The distinction between testing the waters and committing capital has vanished. Investors are moving away from the idea that crypto is merely a high-risk bet. For many, it has become a fundamental part of a diversified strategy.

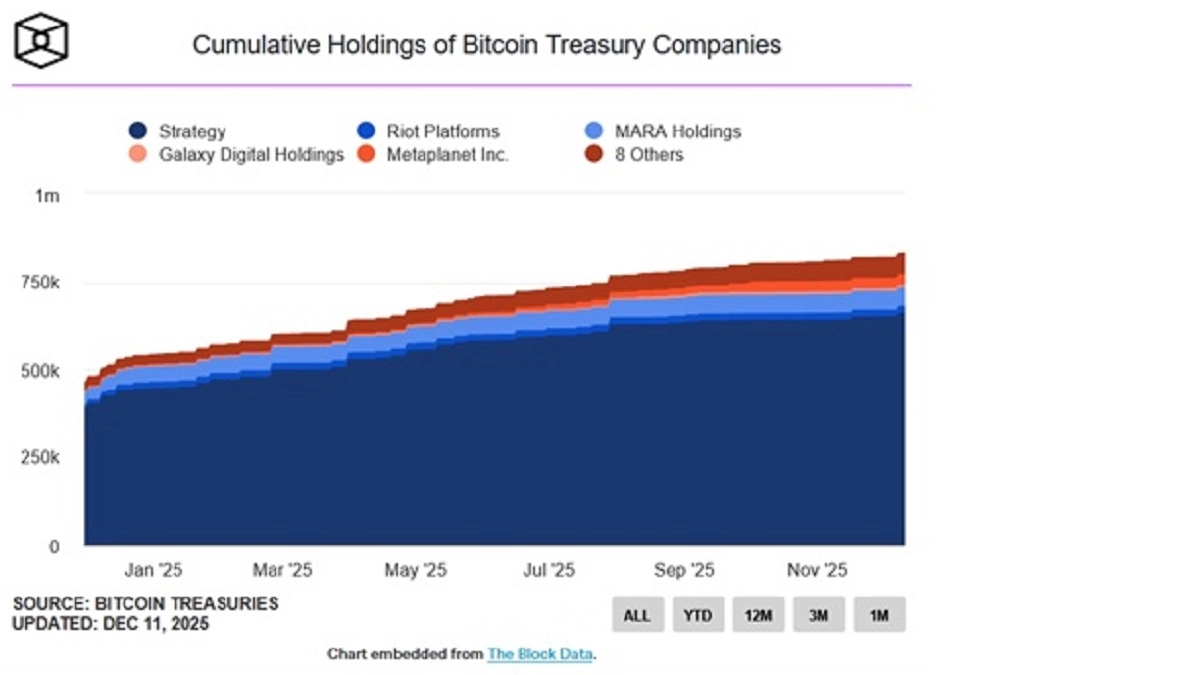

Publicly traded companies alone now hold about 1.076 million BTC, locking up more than 5.12% of the asset's total supply. This accumulation indicates that digital assets are becoming a fixture on corporate balance sheets, viewed as a hedge and a store of value rather than a speculative trade.

Capital continues to flow heavily into US spot crypto ETFs. Bitcoin funds led the way with $22.47 billion in year-to-date inflows—followed by Ethereum funds at $10.43 billion. Newer options are also proving popular: XRP ETFs have collected $944.13 million since their late 2025 launch. Meanwhile, Solana ETFs added $656.61 million. These figures suggest that investors are diversifying their exposure across the asset class.

The market penetration remains in its early stages despite these volumes. Brad Garlinghouse, CEO of Ripple, highlighted the immense room for growth during the panel discussion: "Only 1–2% of the global ETF market is in crypto—that won't stay small for long."

While the investment case is strong, the operational argument is equally compelling. Institutions are recognizing that blockchain technology offers efficiency gains that traditional settlement rails cannot match.

Lily Liu, President of the Solana Foundation, emphasized this operational reality, stating, "Institutions are realizing blockchain cuts hundreds of millions in tech overhead—that's pure bottom line." This dual narrative of asset appreciation and operational efficiency is driving the sector from a speculative fringe into the core of global finance.

The Regulatory Unlock: CLARITY and GENIUS Acts

The primary catalyst for this institutional confidence is the removal of the hostile label that once plagued the industry. Legislative breakthroughs in the United States, specifically the CLARITY Act and the GENIUS Act, have replaced uncertainty with a predictable framework.

The CLARITY Act successfully delineated the jurisdictional boundaries between the CFTC and the SEC, categorizing assets into digital commodities and investment contracts. This distinction removed the ambiguity that previously kept asset managers on the sidelines.

The GENIUS Act provided a necessary federal structure for stablecoins, removing ambiguity for payment and settlement providers. The market responded accordingly, with stablecoin capitalization hitting $312.63 billion in 2025, a 49.17% increase year-to-date, and the total holder count exceeding 208 million. This codified environment also acted as a catalyst for tokenized real-world assets, a sector that expanded by 232% year-to-date to reach a market cap of $18.36 billion.

Exchanges have had to adapt their operations to fit this new compliance-first reality. Binance, having navigated stringent global frameworks, has emerged as a case study in this transformation. Richard Teng reinforced this commitment to governance, stating, "We're now the most regulated crypto entity globally—21 jurisdictions and counting… 22% of our team works in compliance." This pivot toward heavy compliance staffing reflects the new standard for exchanges wishing to serve institutional clients.

The government has also signaled its own long-term commitment to the sector. The executive order establishing a Strategic Bitcoin Reserve and US Digital Asset Stockpile indicates that the state is no longer just a regulator but a stakeholder. This alignment between federal strategy and private sector innovation has created a tailwind that is difficult for institutional capital to ignore.

The Infrastructure of a New Financial Era

Heading into 2026, the market is trading its reputation for volatility for a period of steady expansion, driven by the completion of critical financial infrastructure. The "pipes" of digital finance—custody solutions, ETFs, and clear settlement laws—are now in place. Innovation is shifting toward the application layer, particularly at the intersection of blockchain and artificial intelligence. The Web3 AI agent economy has already reached a market cap of $6.19 billion, with over 16,000 agents active on protocols like Virtuals.

The narrative has evolved from competition to collaboration. The industry is no longer viewed as a zero-sum game between different blockchains or exchanges, but as a unified financial layer. Brad Garlinghouse summarized this cooperative outlook effectively: "We want Solana to do great, Binance to do great—it's an ecosystem play, not a zero-sum game."

With the CLARITY and GENIUS Acts providing the rules of the road, and major institutions allocating capital for the long haul, the focus has shifted. The question is no longer whether crypto is safe enough for institutional money, but how institutions can best capture the value of this new asset class. Regulatory clarity has flipped the script from risk mitigation to opportunity capture, setting the stage for a new era of digital finance.

(The above story first appeared on LatestLY on Dec 30, 2025 07:17 AM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly