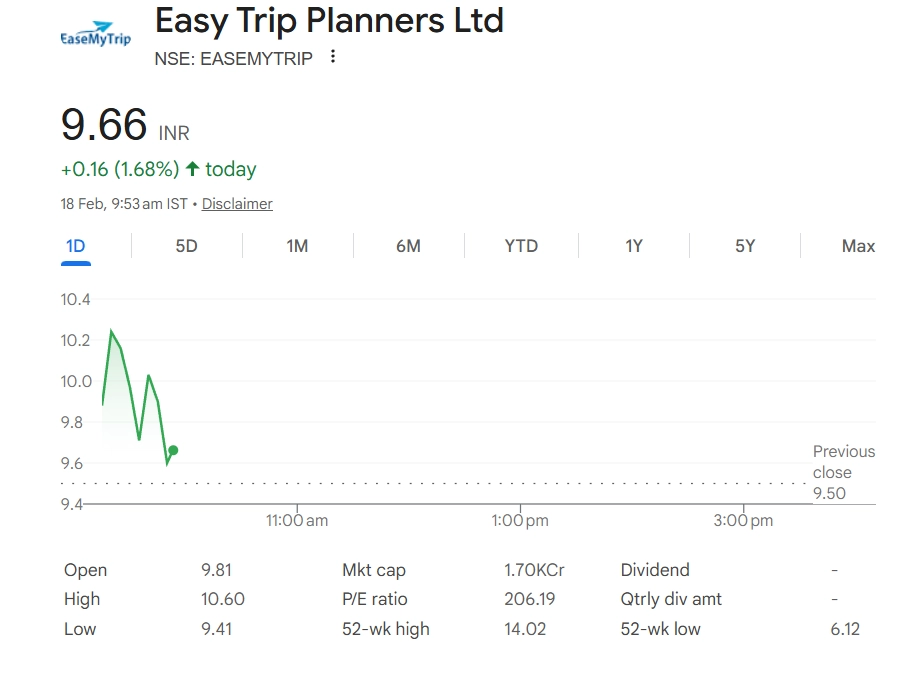

Easy Trip Planners Ltd (NSE: EASEMYTRIP) shares were trading at INR 9.69, up 2.00% on February 18 as investor interest in travel-tech stocks continued. The rise comes amid broader market activity and recent news that EaseMyTrip plans to raise up to INR 500 crore to fund expansion into hospitality and holiday businesses, a move seen as a growth catalyst. Market watchers say strategic fund raising, strong trading volume and travel sector optimism have supported the stock’s performance, though fundamentals and volatility remain key factors for investors to monitor. Stocks To Buy or Sell Today, February 18, 2026: HAL, Vedanta, and Cochin Shipyard Among Shares That May Remain in Spotlight on Wednesday.

EaseMyTrip Share Price

(SocialLY brings you all the latest breaking news, fact checks and information from social media world, including Twitter (X), Instagram and Youtube. The above post contains publicly available embedded media, directly from the user's social media account and the views appearing in the social media post do not reflect the opinions of LatestLY.)

Quickly

Quickly