Despite recent market-wide volatility, BNB's fundamental strengths—driven by its expansive multi-chain utility, deflationary tokenomics, and superior on-chain activity—are attracting a new class of serious investors.

Beyond sovereign interest, evidenced by Kazakhstan's state-backed fund, a growing wave of US corporations and institutional players like Franklin Templeton are now integrating BNB into their strategies. This influx of corporate capital, combined with key catalysts like VanEck's recent ETF filing, makes a compelling case for BNB's long-term growth and its emergence as a cornerstone digital asset for institutional portfolios.

A Test of Strength in a Volatile Market

Recent market turbulence put digital assets to the test, culminating in a historic liquidation event in October that wiped out over $19 billion in leveraged positions. Amid the widespread panic, BNB demonstrated notable resilience. While many altcoins lost half their value, BNB’s drop was contained to just 9.6%.

BNB held its ground above $1,100 even as the market cratered, proving its deep liquidity and the confidence investors have in it. It wasn't just another altcoin weathering the storm; it behaved like a safe haven, a role that until now has been almost exclusively Bitcoin's. This stability is a key reason why corporate treasuries, seeking reliable digital assets beyond Bitcoin, are now turning their attention to BNB.

However, BNB has not been entirely immune to macro uncertainty. Fears over the China-US trade war and murky signals on Fed rate cuts created headwinds, causing a 12.3% dip for BNB in the last seven days. It wasn't alone—the entire crypto market cap dropped 6.9% to $3.55 trillion, dragging Bitcoin down 5.53%, Ethereum 11.5%, and Solana 14.3%. Meanwhile, XRP regained its 4th rank from BNB following Ripple's recent $500 million raise.

On-Chain Strength Attracts Institutional Giants

On-chain data tells a compelling story about BNB Chain's fundamental strength. This is especially true when put side-by-side with Ethereum. BNB Chain shows clear dominance in raw network usage, a key factor attracting institutional players who demand proven utility.

On November 5, 2025, over 19.2 million transactions were processed on BNB Chain, a figure that dwarfs Ethereum's 1.58 million. This massive user base, with over 4.7 million daily active users far ahead of Ethereum's 500,100, is precisely why a major asset manager like Franklin Templeton ($1.6T AUM) recently integrated its Benji Technology Platform with BNB Chain to scale its tokenized products.

While Ethereum leads in DeFi TVL, BNB Chain's edge in stablecoin adoption, with 46.8 million holders to Ethereum’s 16.42 million, highlights its practical, real-world utility. As Binance CEO Richard Teng noted, "Wall Street's growing embrace of crypto now extends far beyond the spot exchange-traded funds (ETFs) that dominated headlines in 2024. The creation of composite products and new models based on traditional instruments is accelerating, with BTC—and soon, other digital assets—becoming a cornerstone of modern financial infrastructure in many direct and indirect ways."

Deflationary Tokenomics: A Corporate Treasury Magnet

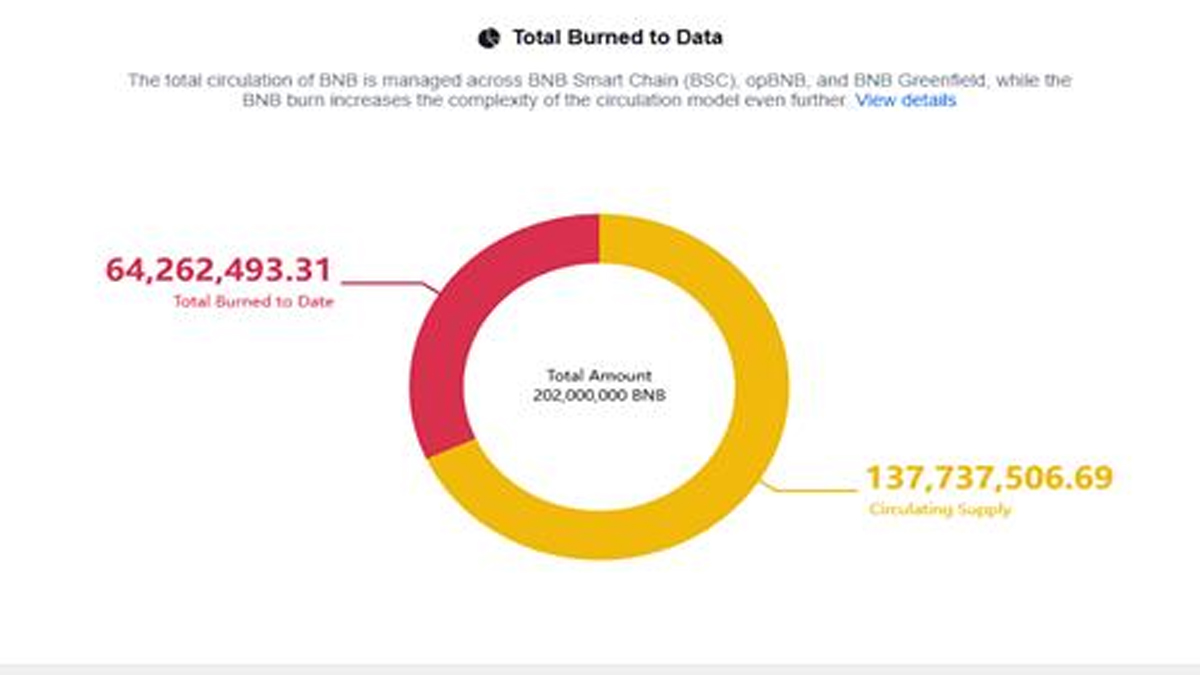

BNB’s deflationary tokenomics serve as a direct value-accrual mechanism for investors, a feature particularly attractive to corporate treasuries focused on long-term asset appreciation. Through its quarterly Auto-Burn mechanism, the supply of BNB is systematically reduced. To date, over 64 million BNB have been permanently removed from circulation.

The current circulating supply is approximately 137.7 million, down from an initial 200 million. This engineered scarcity, which supports long-term value, is a core reason why public companies like Nano Labs and CEA Industries are building substantial BNB positions on their balance sheets.

The New Wave of Corporate and Sovereign Adoption

A powerful new class of investor is validating BNB's status as a strategic asset. The trend gained momentum with Kazakhstan's state-backed "Alem Crypto Fund" choosing BNB for its first investment. We're also seeing it with Kyrgyzstan's choice to launch its stablecoin on BNB Chain and with Ondo Global Markets bringing tokenized stocks and ETFs to the ecosystem.

Now, a wave of publicly traded US companies is following suit. CEA Industries (Nasdaq: VAPE) announced a $500 million PIPE to build one of the largest public BNB treasuries, and now holds 480,000 BNB. Similarly, Nano Labs (Nasdaq: NA) secured a $500 million convertible note deal to fund its BNB treasury, with the long-term goal of holding up to 10% of the circulating supply.

Biopharmaceutical firms like Windtree Therapeutics (Nasdaq: WINT) and Liminatus Pharma (Nasdaq: LIMN) have also announced plans to allocate hundreds of millions to BNB reserves. This corporate buying is complemented by institutional moves like China Renaissance seeking $600 million for a US-based, publicly traded BNB treasury company.

As Binance founder Changpeng Zhao (CZ) put it, BNB's solid performance isn't about market manipulation; it's rooted in its strong community and deflationary design. It's this fundamental resilience that is now pulling in a new, more influential type of global investor.

Valuation and Risks: An Investor's Perspective

BNB's performance numbers speak for themselves.

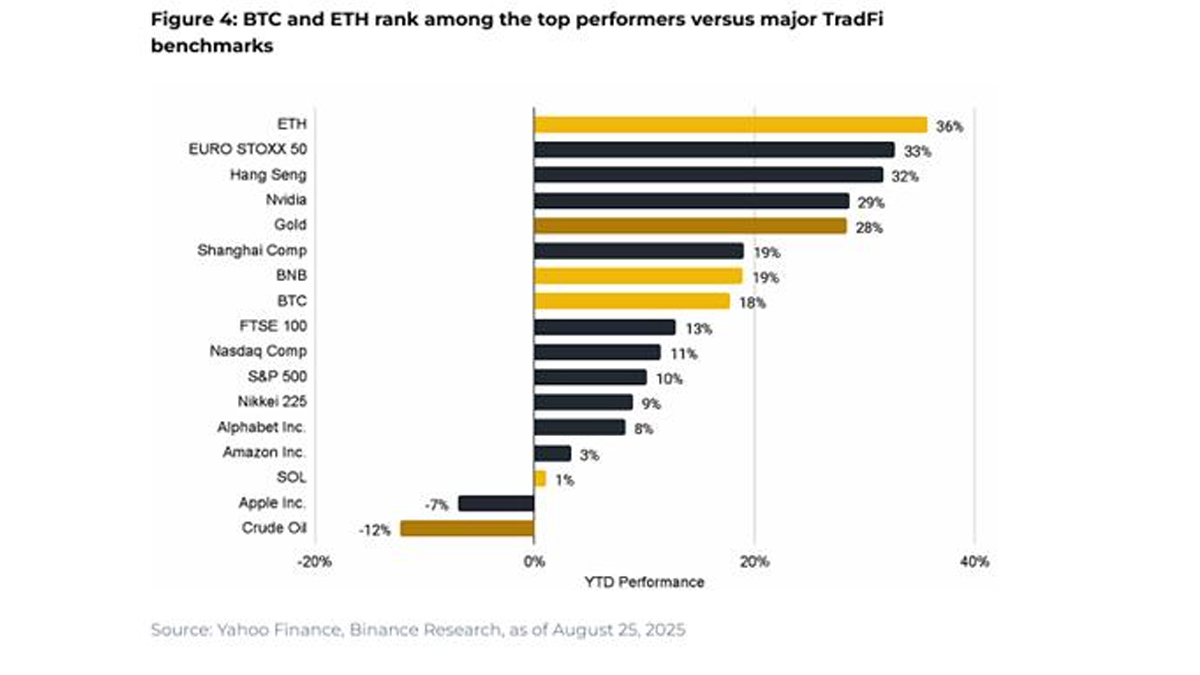

An August 27 Binance Research report shows its 19% year-to-date gain in 2025 beats Bitcoin (18%) and the S&P 500 (10%).

On the valuation front, metrics like fully diluted market cap (FDMC) to fees suggest BNB is a bargain. It is significantly cheaper at 245.3x than Ethereum (794.1x) and Solana (319.3x)—making it an attractive option for institutional investors seeking value.

But investors must also weigh the risks. Questions about centralization persist due to BNB Chain's small 45-validator set compared to Ethereum's 953,000. Regulatory uncertainty also remains a factor. Yet, despite these risks, major asset managers like VanEck are moving forward with the first-ever US spot BNB ETF filing, signaling that large financial players have assessed these challenges and still see a clear path to long-term value.

A New Chapter for a Maturing Asset

BNB has proven its fundamental strength through its superior on-chain activity and resilience during market turmoil. Its deflationary token burns provide a strong value accrual model, now validated by a clear and growing wave of corporate and institutional adoption.

For investors, monitoring the influx of treasury allocations from public companies alongside on-chain metrics now offers a clearer signal of BNB's health than short-term price headlines, marking a new, institution-led chapter for this maturing asset.

(All articles published here are Syndicated/Partnered/Sponsored feed, LatestLY Staff may not have modified or edited the content body. The views and facts appearing in the articles do not reflect the opinions of LatestLY, also LatestLY does not assume any responsibility or liability for the same.)

Quickly

Quickly