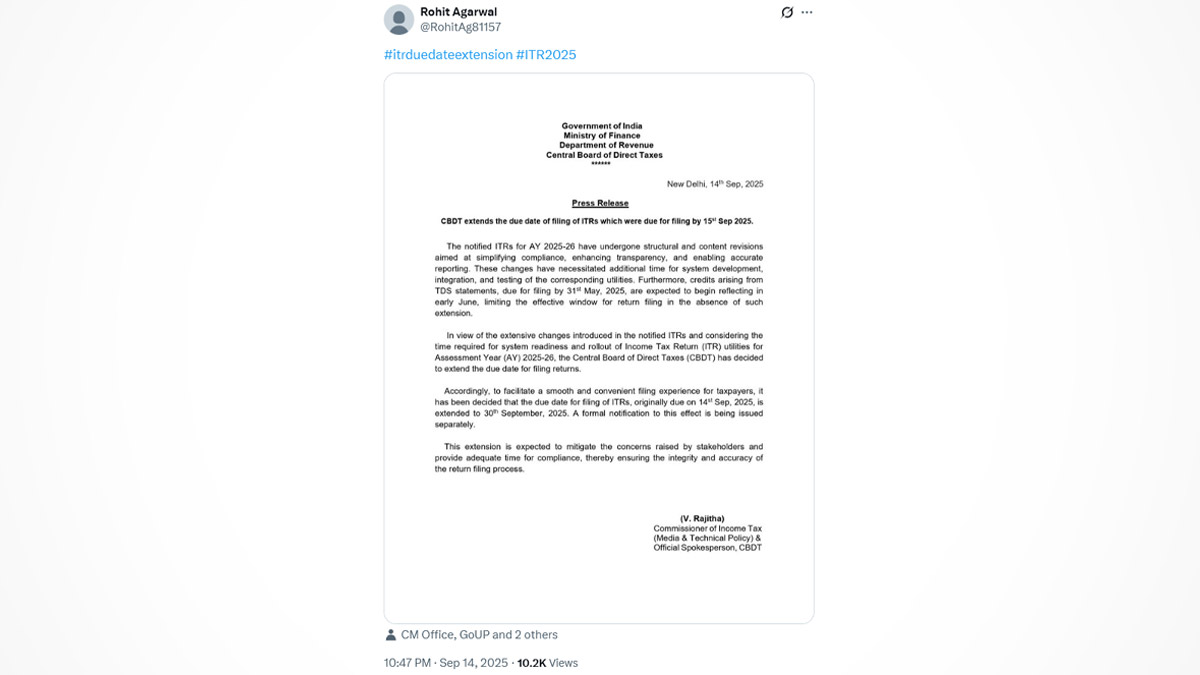

Mumbai, September 17: A notice has been circulating on social media, claiming that the Central Board of Direct Taxes (CBDT) has decided to extend the due date for Income Tax Return (ITR) filing until September 30. The circular attributed to the Income Tax of India led many users to mistakenly believe it was genuine.

The letter, purportedly issued by CBDT, was shared on X by a user ‘Rohit Agarwal’. "In view of the extensive changes introduced in the notified ITRs and considering the time required for system readiness and rollout of Income Tax Return (ITR) utilities for Assessment Year (AY) 2025-26, the Central Board of Direct Taxes (CBDT) has decided to extend the due date for filing returns," the purported letter read. "Accordingly, to facilitate a smooth and convenient filing experience for taxpayers, it has been decided that the due date for filing of ITRs, originally due on 14 Sep, 2025, is extended to 30th September, 2025. A formal notification to this effect is being issued separately," It further said. ITR Filing Deadline Extension: CBDT Changes Last Date To File Income Tax Returns to September 16.

Fake Circular Claiming CBDT Extended ITR Filing Deadline to September 30

ITR Filing Deadline Extended to September 30?

However, when we, at LatestLY, fact-checked the claim, we found that it was fake. We landed upon a press release issued by CBDT on September 15, which said the board had granted a one-day extension to ITR filing, setting the final deadline as September 16, 2025.

Official Press Release by CBDT on ITR Filing Deadline Extension

KIND ATTENTION TAXPAYERS!

The due date for filing of Income Tax Returns (ITRs) for AY 2025-26, originally due on 31st July 2025, was extended to 15th September 2025.

The Central Board of Direct Taxes has decided to further extend the due date for filing these ITRs for AY… pic.twitter.com/jrjgXZ5xUs

— Income Tax India (@IncomeTaxIndia) September 15, 2025

Even before the September 16 extension, the ITR deadline was extended from July 31 to September 15 after there were several technical issues reported while filing, including portal glitches and data mismatches. ITR Filing Last Date: Income Tax Portal Down Amid Last-Minute Rush, Allege Taxpayers As They Scramble To File Returns on Final Day of Deadline.

Can ITR Be Filed After the Last Date?

And, even though September 16 was the last date to file an ITR, this does not mean that an ITR cannot be filed after this date. Any ITR which is filed after the due date, which is September 16 for individuals, is called a belated ITR, and it can be filed till December 31, 2025. Although you can still comply with the law and file an ITR after the due date (belated ITR), this ITR has its own limitations, such as a late fee and some adverse consequences.

If the total income is up to INR 5 lakh, the penalty is capped at INR 1,000. For individuals earning more than INR 5 lakh, the penalty rises to INR 5,000. Beyond this, if any tax is due, the taxpayer will also be liable to pay interest for the delay in payment.

Fact check

Income Tax Return (ITR) filing deadline extended to September 30, 2025.

No, CBDT has not extended ITR filing deadline to September 31. The claim is fake.

(The above story first appeared on LatestLY on Sep 17, 2025 12:13 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly