The Permanent Account Number or PAN Card is one of the most important documents for all the citizens of India. The 10-digit alphanumeric is considered to be a document of identity for all Indians. If an individual doesn’t have a PAN card, he will not be able to carry out several financial transactions. PAN is a unique ten-character alphanumeric number assigned to every Indian income taxpayers. It must be noted that the PAN card is allotted to all the citizens of the country by the Indian Income Tax Department.

Along with PAN card, the IT-department also allots a unique account number to a tax-paying person, company or HUF. The validity of a PAN Card is for a lifetime, means your PAN card once made, will serve the purpose for the lifetime.

If an individual doesn’t have a PAN card, worry not! You can apply for it in easy ways. Individuals can apply for a PAN Card, change or correct the details on PAN can be made online. If an individual wants to make the PAN card online, it can be done on either of the sites -the NSDL website OR UTIITSL website.

These two websites have been authorized by the government of India to issue the PAN or to make changes/corrections in the PAN on behalf of the Income Tax Department. How to Unlink Aadhaar With Bank Account, Mobile Number and Private Wallet Services.

To apply online:

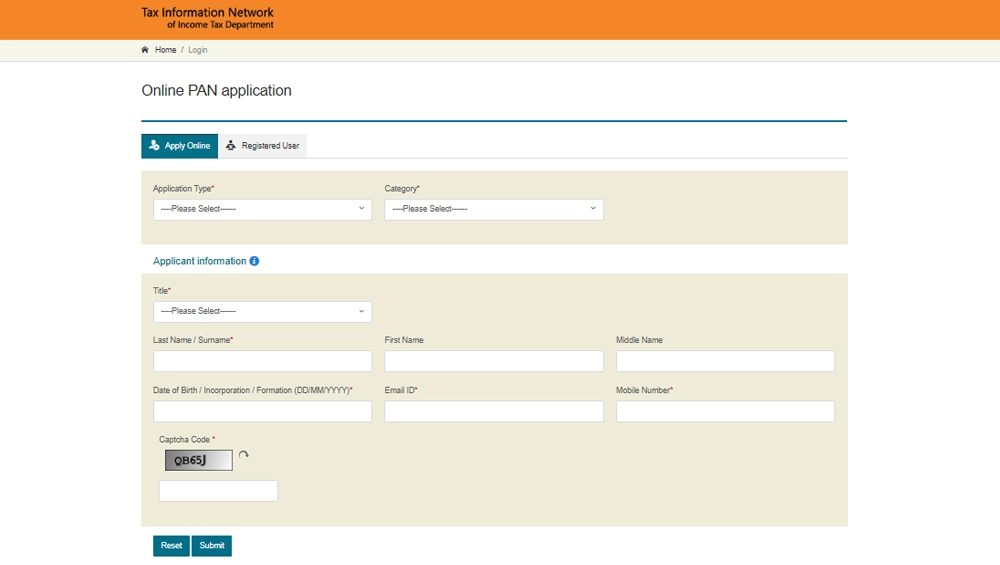

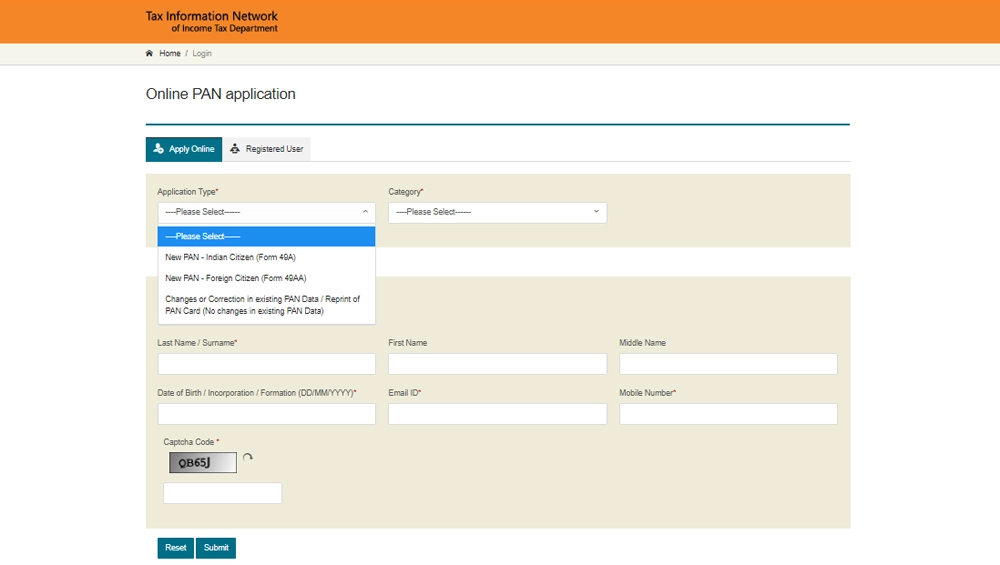

- Visit the NSDL website UTIITSL website and fill all the details correctly that have been asked. On the page, the first option is ‘Application Type’, where you can choose from three options namely, New PAN for Indian citizen, New PAN for a foreign citizen, Changes or Correction in Existing PAN data.

Apply for PAN card Online (Photo Credits: File Photo)

Apply for PAN card Online (Photo Credits: File Photo) - If you want a new PAN card, chose the first or second option from the dropdown depending on your nationality. If you are an Indian citizen, chose the first, if you are a foreign citizen, choose the second option.

Apply for PAN card Online (Photo Credits: File Photo)

Apply for PAN card Online (Photo Credits: File Photo) - If you wish to make any changes or do a correction in your existing PAN details, you can choose the third option.

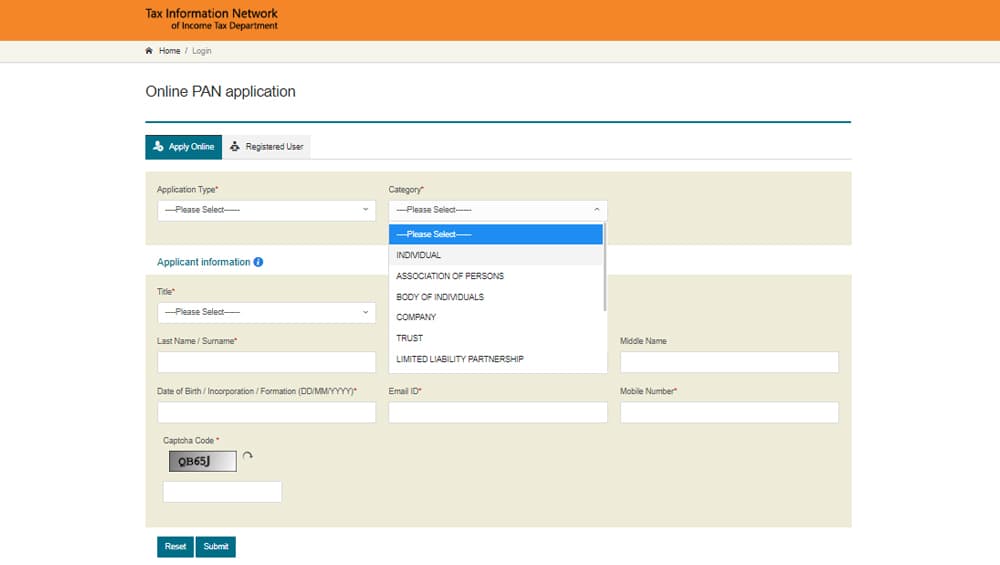

- In the Category section, choose from the options given. If you are applying for your own self or any single person, choose individual.

Apply for PAN card Online (Photo Credits: File Photo)

Apply for PAN card Online (Photo Credits: File Photo) - Once the details are correctly filled, submit the online application form along with the payment of the respective processing fee.

- The charges for applying for PAN is Rs. 93 (excluding GST) for Indian communication address and Rs. 864 (excluding GST) for foreign communication address.

- It must be noted that payment of application fee can be made through credit/debit card, demand draft or net-banking.

- On successful payment, an acknowledgement will be displayed. An individual is required to save the acknowledgement number for further reference.

- The copies of required documents can then be sent by post to either NSDL or UTIITSL

- The agency will then take up the verification process. It is only after the receipt of the documents, PAN application would be processed by NSDL.

Documents required to apply for PAN card:

Applying for a PAN card online is a hassle-free process. The documents include one proof of identity, one proof of address and one proof of date of birth. Take a look here for complete list of documents.

How to Download PAN card:

A user is required to fill and submit the online application form along with online payment of the respective processing fee and after the successful processing of the application. After this, the E-PAN card will be sent to the PAN applicant at the email id from where a user can download a copy of the same.

An individual can download the e-PAN from digilocker, a Government of India platform where citizens can store and access digital documents anytime, anywhere and share it online.

- Go to https://digilocker.gov.in/public and sign up using your Aadhaar number

- On the left-hand side of the page, click on Issued Documents.

- Click on the message which shows a link on 'Pull documents'.

- In the partner's name section, select 'income tax department, Govt of India' from the dropdown and in document type select 'PAN verification record'

- After this enter your Name, Date of Birth, PAN No and other details and then click on 'Get document'.

- Your PAN data will be fetched. After this, your pan card will be downloaded in the digilocker and will be available under issued documents list.

- You can view your PAN card and download a soft copy of it from there.

If you have made a mistake while filling in details for the PAN or if you wish to get some correction done, you can do it online without much efforts. If an individual wants to make changes in the existing PAN such as a change in name, date of birth etc, you can apply for it online. In case of corrections in PAN, a user is needed to submit the documents to support the change required in PAN.

(The above story first appeared on LatestLY on Nov 02, 2018 05:05 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly