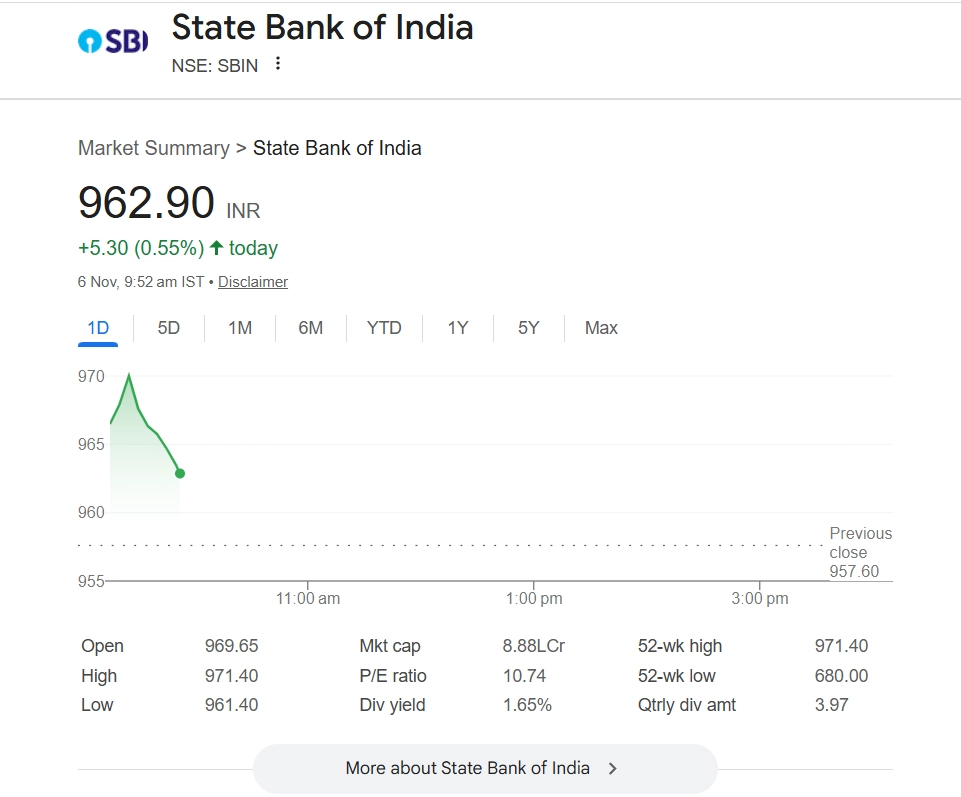

State Bank of India (NSE: SBIN) gained 0.56% to INR 963 in early trade on Wednesday after its July–September quarter results surpassed expectations, prompting several brokerages to raise earnings forecasts and price targets. The optimism followed SBI’s robust core operating performance, steady loan growth, and improved asset quality, aided by a one-time gain from its partial stake sale in Yes Bank. The PSU lender reported a 10% year-on-year rise in net profit to INR 20,159.7 crore for Q2 FY26, including INR 4,593 crore earned from divesting a 13.18% stake in Yes Bank. Net interest income rose 3.3% to INR 42,985 crore, while gross NPAs improved to 1.73% from 1.83% last quarter, and net NPAs dropped to 0.42%. Analysts see further upside for SBI amid resilient margins and healthy credit demand. Stocks to Buy or Sell Today, November 6, 2025: Interglobe Aviation, Indian Hotels Company, and Berger Paints Among Shares That May Remain in Spotlight on Thursday.

SBI Share Price Today

(SocialLY brings you all the latest breaking news, fact checks and information from social media world, including Twitter (X), Instagram and Youtube. The above post contains publicly available embedded media, directly from the user's social media account and the views appearing in the social media post do not reflect the opinions of LatestLY.)

Quickly

Quickly